Economy and Finance

The core goal of economic policy must be to achieve wellbeing for all while living within environmental limits and delivering fairness, equality, dignity, connection, participation and regenerating nature.

Read this chapter

The focus of economic policy should be principally on the composition and direction of development, not the rate of GDP increase.

Economic policy must prioritise meeting climate change targets, reducing use of raw materials, setting and making our country more equal (both in terms of economic outcomes, and in terms of race, gender and disability amongst other protected characteristics).

Discussions about the economy must fundamentally break with the failed economic models of the past and acknowledge and combat existing forces that continue to take the economy in the wrong direction, towards climate crisis, environmental and biodiversity breakdown and increasing inequalities. Patterns of ownership, business models and the power of rent extraction will have to be considered.

We should explore plans to empower workers so they can reduce their working time and so share work more equally across society and put a higher value on, and adequately resource, caring responsibilities of all forms.

There needs to be a different relationship between the public and the private realms. The government needs to be decisive in setting the direction of development for the economy and in showing how enterprises can and should contribute to that. Government also has a vital role in ensuring free and universal access to foundational services and the infrastructure (physical and social) that the future economy needs.

In 2022 SCCS published our ‘Financing Climate Justice’ report and this chapter draws on many of the policies recommended there. In particular we recommended that the Scottish Government set up an independent working group to look at the ideas and proposals for raising additional revenue and influencing behaviour in the report and advise Ministers how to take them forward, including what to include in the next Programme for Government.

The Scottish Government has recently announced an external tax stakeholder group to “ensure our future tax strategy is informed by a broad range of views.”76

What is a Wellbeing Economy?

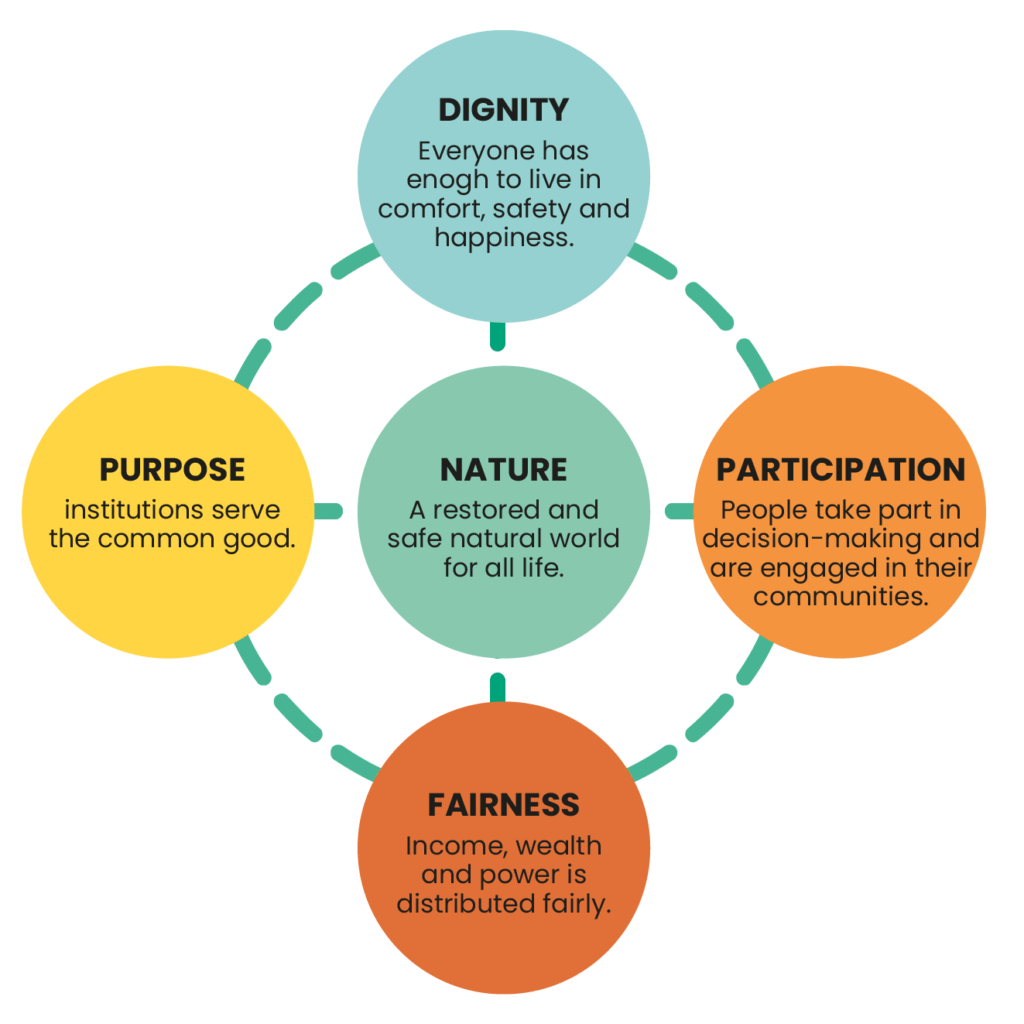

A number of members of SCCS are also members of the Wellbeing Economy Alliance Scotland77 which describes a Wellbeing Economy thus:

“A Wellbeing Economy is an economy designed to deliver good lives on a healthy planet. The economy we have inherited is driven by a very different motive – to continually grow the economy so there are more goods and services in circulation without paying too much attention to what this means in practice for people and planet. Then governments set aside some of this money in taxes to put sticking plasters on the casualties of our economic system – such as poverty and climate breakdown.”

In a Wellbeing Economy we would first ask, how can we ensure everyone has enough to live a dignified life – a life that allows us to connect with others, to participate in the decisions that affect us and to enjoy a healthy natural environment? From there we would ask, which businesses and industries do we need to nurture, and which need to be scaled down? And how can we do this equitably?

In a Wellbeing Economy, we would prioritise policies that meet our fundamental human needs – not endless GDP growth for its own sake.

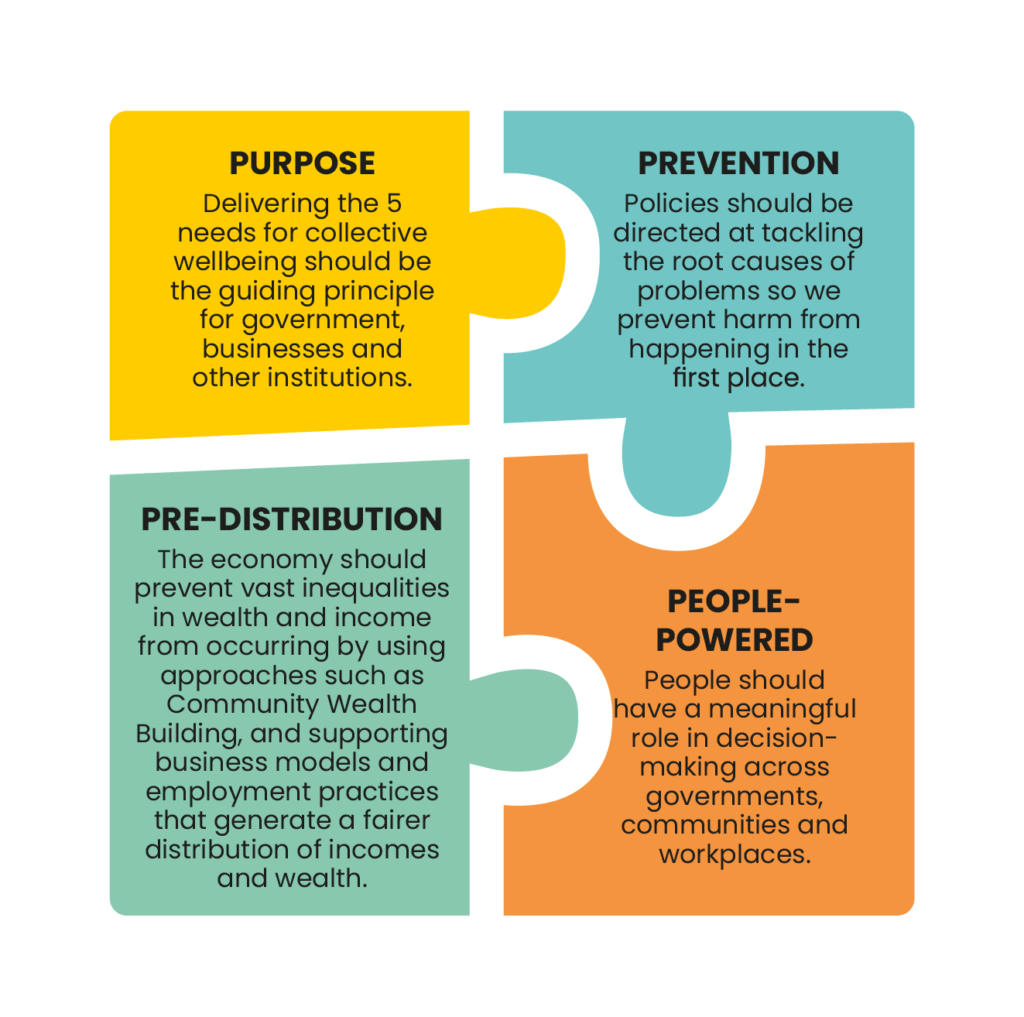

The five WEAll needs were co-produced with members from around the world. They echo concepts that are found in religious texts, indigenous teaching and numerous surveys about what really matters to people. To get there, we’ll need to see four big shifts in policy and practice.

For further information:

- Financing Climate Justice, SCCS, 2022, https://www.stopclimatechaos.scot/wp-content/uploads/2022/09/FinancingClimateJustice_Report_ONLINE.pdf

- Response to announcement about the new Economic Transformation Strategy and appointment of the Advisory Council, FoE Scotland et al, 2021, https://www.scotlink.org/wpcontent/uploads/2021/08/Statement-about-Economic-Transformation-Strategy-Aug-2021.pdf

Medium-Term Financial Strategy: Ministerial statement, Scottish Government, May 2023, https://www.gov.scot/publications/mediumterm-financial-strategy-ministerial-statement/

Wellbeing Economy Alliance Scotland home page, https://www.weallscotland.org

The Scottish Government has often linked the economy to the pursuit of a healthy society and the protection of the environment, for example:78

“Achieving a sustainable economy, promoting good governance and using sound science responsibly are essential to the creation and maintenance of a strong, healthy and just society capable of living within environmental limits.”

The National Strategy for Economic Transformation79 says:

“Our vision is to create a wellbeing economy: a society that is thriving across economic, social and environmental dimensions, and that delivers prosperity for all Scotland’s people and places. We aim to achieve this while respecting environmental limits, embodied by our climate and nature targets.”

These are fine words but our continued failure to meet climate targets and the strong likelihood that we will miss future targets, demonstrate that economic policy still does not deliver on climate objectives and continues to prioritise traditional GDP growth.

The Scottish Government has also made a strong commitment to using tax to deliver on climate objectives. Its 2021 Framework for Tax80 says

“tax policy will also play a crucial role in ensuring fiscal sustainability, tackling climate change and reducing inequality” and aims to align tax policies with the Climate Change Plan over time. It also says: “we will consider how the tax powers that we have could help change behaviour, supporting the transition to a net zero economy” and “whilst the majority of green tax powers are reserved, we will pursue changes at every level to deliver on Scotland’s climate and environmental ambitions.”

Positively, the Government has commissioned research to examine international evidence on the potential role of fiscal levers to deliver reductions in greenhouse gas emissions.81

The Resource Spending Review82 – which sets out the parameters of spending to 2026-7 and high-level spending plans – has the climate and nature crises as one of its five priorities, saying

“the spending review comes at a critical point in the global challenge to address the climate crisis, adapting to the impacts of the irreversible change that is already evident and seeking to mitigate the extent of future change through a Just Transition.”

A recent Reform Scotland report83 finds that the Scottish Government undertakes only a limited assessment of the consumption-based carbon emissions associated with spending in the Scottish Budget and has “not, as yet, included a more comprehensive assessment or extended this to include the impact of revenue-raising.” It also recommends that fiscal policies should all be assessed for their impact on climate change.

In their report on a Green Recovery84 the Scottish Parliament’s Environment, Climate Change and Land Reform Committee recommended wider application of ‘conditionality’ to public funding:

“The Committee recommends any model for future funding support to business and the third sector must consider conditionality and opportunities to include measures which relate to supporting the delivery of social and environmental objectives. Specifically, the Committee recommends that, where appropriate, support should be conditional on action to reduce emissions in alignment with any route-map to net-zero, and a green recovery. Sectors which require urgent action in this regard are fossil fuel extraction and use, transport, agriculture and manufacturing.”

and

“The Committee recommends public funding must be accompanied by a published set of conditions on achieving relevant public objectives (e.g. net-zero, biodiversity, fair work, diversity and inclusion, circular economy). All applications for funds must include an action plan to achieve the conditions, with the detail proportionate to the scale of funding. Action plans should be publicly available, where appropriate.”

Scotland’s National Marine Plan, Scottish Government, 2015, https://www.gov.scot/publications/scotlands-national-marine-plan/pages/5/

Delivering Economic Prosperity – the national strategy for economic transformation, Scottish Government, 2022, https://www.gov.scot/binaries/content/documents/govscot/publications/strategy-plan/2022/03/scotlands-national-strategy-economic-transformation/documents/delivering-economic-prosperity/delivering-economic-prosperity/govscot%3Adocument/delivering-economic-prosperity.pdf

Framework for Tax 2021, Scottish Government, 2021, https://www.gov.scot/publications/framework-tax-2021/

Tender: International evidence on the potential role of fiscal levers to deliver reductions in greenhouse reductions, Scottish Government, May 2023, https://www.publiccontractsscotland.gov.uk/search/show/search_view.aspx?ID=MAY479172

Investing in Scotland’s Future: Resource Spending Review, Scottish Government, 2022, https://www.gov.scot/binaries/content/documents/govscot/publications/strategy-plan/2022/05/investing-scotlands-future-resource-spending-review/documents/investingscotlands- future-resource-spending-review/investing-scotlands-future-resource-spending-review/govscot%3Adocument/investingscotlands- future-resource-spending-review.pdf

Taxing Times: Why Scotland needs new, more and better taxes, Reform Scotland, 2022, https://reformscotland.com/wp-content/uploads/2022/07/Taxing-Times-Why-Scotland-needs-new-more-and-better-taxes.pdf

Green Recovery report, Environment, Climate Change and Land Reform Committee, 2020

Green Recovery report, Environment, Climate Change and Land Reform Committee, 2020, https://sp-bpr-en-prod-cdnep.azureedge.net/published/ECCLR/2020/11/8/Green-Recovery-Inquiry—Report/ECCLRS0520R12.pdf